pay personal property tax richmond va

The Richmond County Treasurers Office bills and collects Real Estate and Personal Property taxes. You have the option to pay by credit card or electronic check.

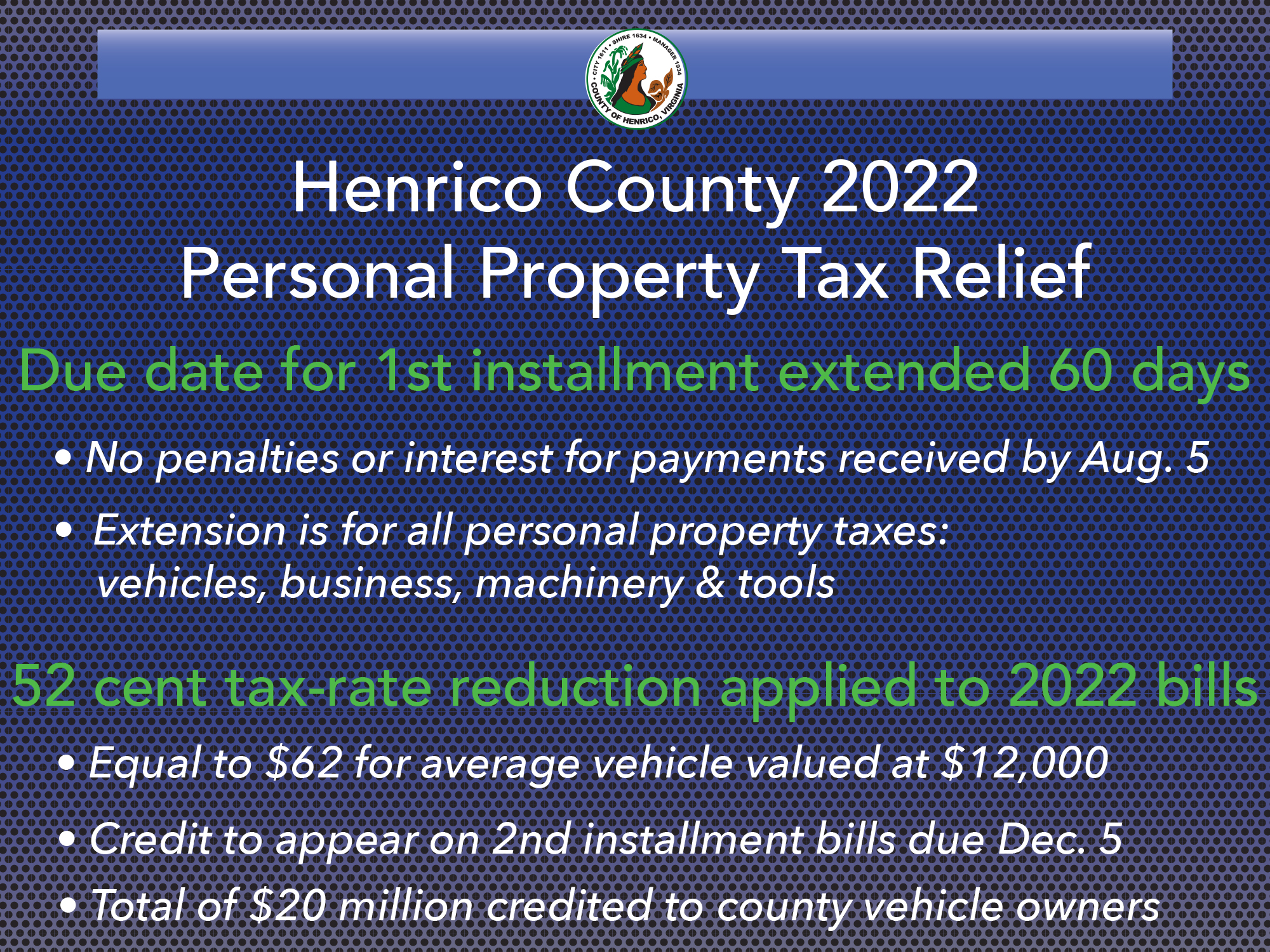

Henrico Leaders To Vote On Personal Property Tax Bill Extension

Property values are determined by the City Assessor and the Department of Finance issues the tax bills based on the valuation information provided by the Assessors Office.

. Call 3-1-1 or 804-646-7000. If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments.

Personal Property Taxes are billed once a year with a December 5 th due date. Taxpayers can either pay online by visiting RVAgov or mail their payments. Call or text 911 Non-Emergency Police.

To create an online payment of the Richmond property tax bill we must select the Proceed to Payment option in the Inquiry section. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. The personal property tax is calculated by multiplying the assessed value by the tax rate.

Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Personal property tax bills have been mailed are available online and currently are due June 5 2022. There is a convenience fee for these transactions.

You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website. The current rate is 350 per 100 of assessed value. On Tuesday the council voted.

Use the map below to find your city or countys website to look up rates due dates. The City of Richmond is authorized by state law to levy taxes on real property in the city of Richmond. Pay property taxes using a credit card.

Pay Personal Property Taxes. Tax rates differ depending on where you live. Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date.

Virginia Department of Taxation. Broad Street Richmond VA 23219. All property is taxable based on ownership.

Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. When do I need to file a personal property return for my car or pickup. Check or money order Make your check or money order payable to.

Richmond County Treasurers Office. Personal Property Registration Form An ANNUAL filing is required on all. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

View account information - past bills current bills and balances owing. Write your 5-digit bill number and your Virginia Tax account number in the memo line. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly.

Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes. Information and Non-Emergency Services. Boats trailers and airplanes are not prorated.

101KB Personal Property Tax Relief Act of 1998. The personal property tax rate is determined annually by the City Council and recorded in the budget appropriation ordinance each year. As June 5 falls on a Sunday all payments postmarked on or before June 6 will not be subject to penalties and interest for late payment.

The Treasurers Offices mission is to treat all of its customers courteously and fairly while maintaining exceptional professionalism and. A service fee is added to each payment you make with your card. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments.

Jun 1 2022 0608 PM EDT. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. The Treasurers Office has several ways you can pay.

Payment of Property Tax with Credit Card in Richmond If we want to pay our tax bill by credit card we select the credit card option then we fill in the box of the amount we want to pay and click on the Continue to Payment Information. By linking your Property Account to your MyRichmond account you will be able to. Offered by City of Richmond Virginia.

Circuit Court Clerk for the City of Richmond VA. For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at. WRIC Richmond residents will have an extra two months to pay their personal property taxes after the City Council voted to extend the deadline.

Other collections include dog registration fees building and zoning permit fees and state taxes. You can make Personal Property and Real Estate Tax payments by phone. Use account information from your Property Tax Notice.

Please call the office for details 804-333-3555. If you have questions about personal property tax or real estate tax contact your local tax office. Is more than 50 of the vehicles annual mileage used as a business.

Have your 5-digit bill number and Virginia Tax account number ready. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Offered by City of Richmond Virginia.

When a person initially acquires an automobile or truck andor moves that vehicle into Henrico County that person must file a personal property return. To mail your tax payment send it to the following address. For Personal Property Tax Payments Feel free to contact the office should you have any questions 804-333-3555.

Find out if you have claimed your Home Owner Grant. Disabled Veterans or their surviving spouses who believe they may be eligible for the real. Pay Real Estate Tax.

When Is The Right Time To Sell In 2022 Things To Sell Home Selling Tips Home Buying

Get The Title Of Property Reviewed Before Selling Title Insurance Title Buying A New Home

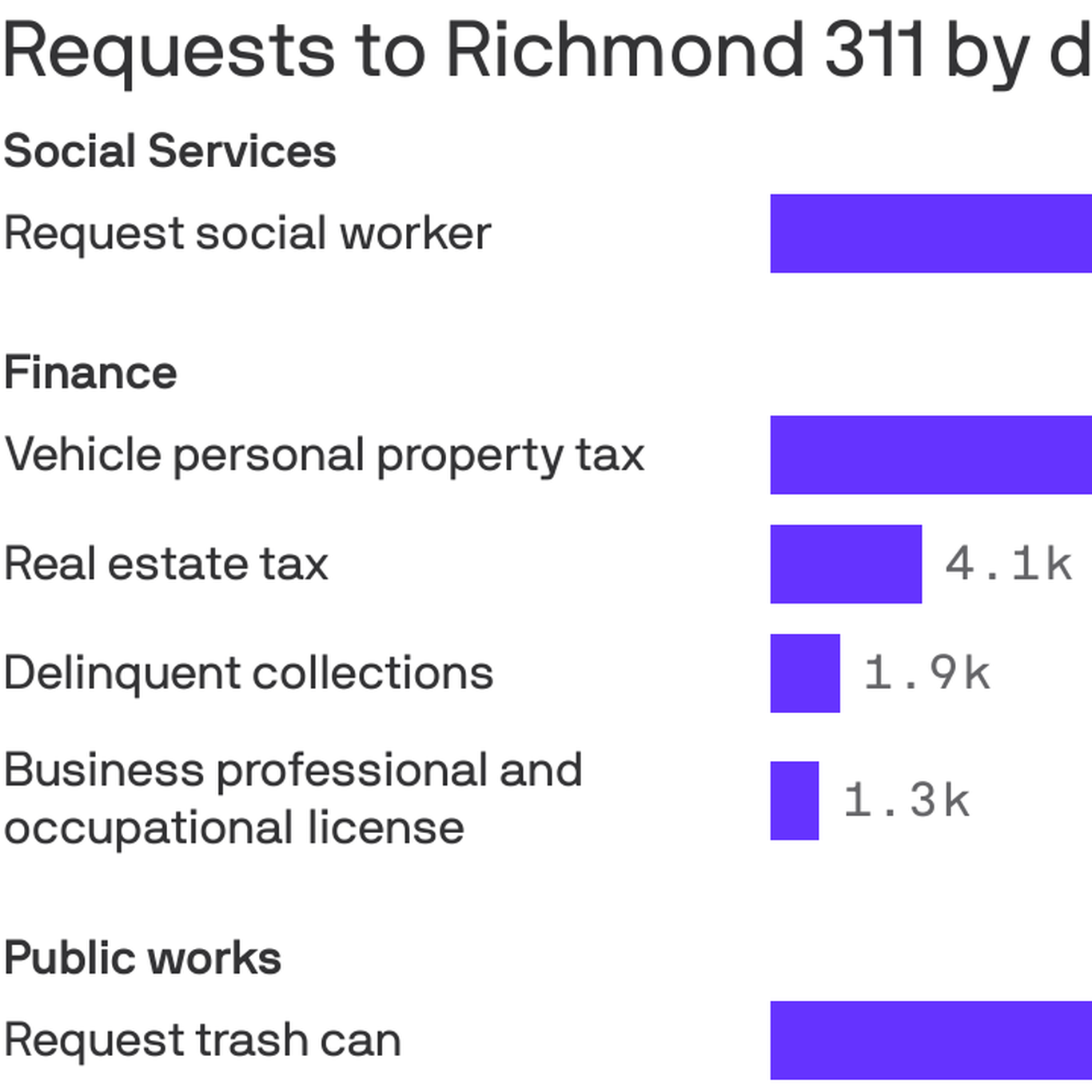

In Richmond Social Services Dominate 311 Requests Axios Richmond

/cloudfront-us-east-1.images.arcpublishing.com/gray/5DJX4GFP45DOVJWLPRIWW5ETVU.jpg)

Colonial Heights Expected To Extend Due Date For Personal Property Tax Bill To July 29

How To Find Tax Delinquent Properties In Your Area Rethority

Population Wealth And Property Taxes The Impact On School Funding

News Flash Goochland County Va Civicengage

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Real Estate Tax Frequently Asked Questions Tax Administration

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Paydayloans Mortgage Checklist Refinance Mortgage Mortgage

Getting A Tax Refund Consider Using It For Your Down Payment Forza Real Estate Buying First Home Tax Refund Money Saving Strategies

Henrico County Announces Plans On Personal Property Tax Relief

Richmond Property Tax 2021 Calculator Rates Wowa Ca

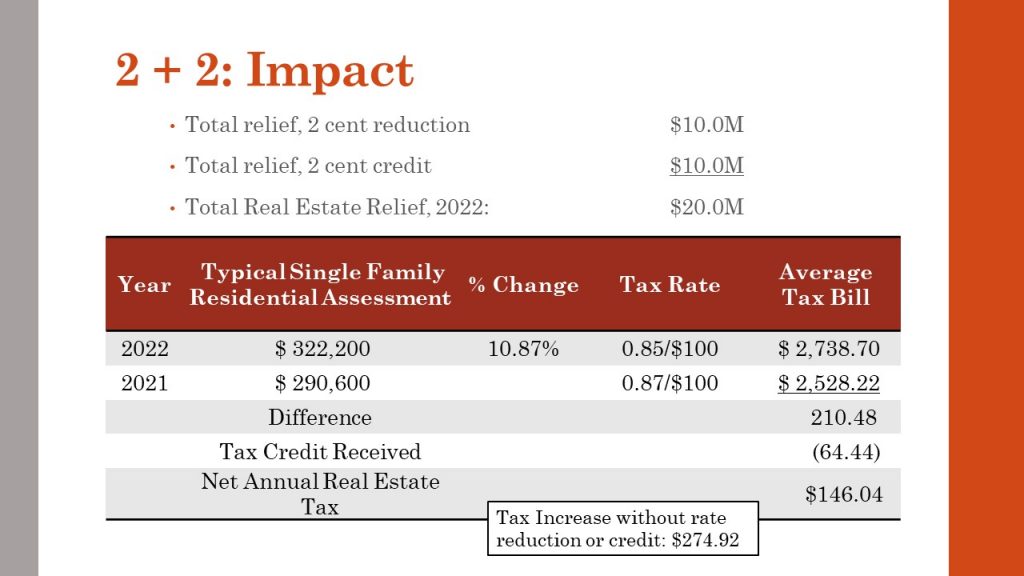

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5