bain capital tech opportunities fund l.p

Street Address 1 Street Address 2. 110 billion Stage of fundraising.

Bain Capital Targets 1 5 Billion For Second Tech Opportunities Fund Mint

- Most recent fund raising on January 25 2022 raised 0 in Other.

. Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates. Is incorporated in the state of Cayman Islands. We draw upon a senior team with industry venture capital public equity and private equity investing experience.

For financial reporting their fiscal year ends on December 31st. The Firm specializes in private and public equity fixed income venture capital and specialty fund investments. The Fund makes ESG buyouts and late-stage minority investments in software and.

While Bain Capital appears to have met the target for its new technology offering the firm has not yet held a final close according to person with knowledge of the matter as as. We partner with disruptive founders to accelerate their ideas to market. 23 2021 708 pm ET.

Inception of Bain Capital Senior Loan Fund LP SLF Venture November 2009. Bain Capital Tech Opportunities was created in 2019 to make investments in technology companies particularly in enterprise software and cybersecurity. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15.

Bain Capital LP operates as a multi-asset investment firm. Ad Explore BlackRocks active equity platform. Ad Our Objective-Based Approach Prioritizes Superior and Repeatable Fund Results.

Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year after wrapping. Bain Capital Tech Opportunities Fund II LP. City StateProvinceCountry ZIPPostalCode Phone Number of Issuer.

Ad An Active Research-Driven Fund Investing In Health-Care Companies Worldwide. Fund 2009 raised 467 million. Bain Capital which manages more than 100 billion is planning to raise 1 billion for a tech-focused fund that will invest in takeovers and late-stage minority investments.

Bain Capital Tech Opportunities Fund Amount raised. Bain Capital Tech Opportunities Fund LP. Credit October 2019.

SEC CIK 0001789820. Bain Capital Tech Opportunities Fund LP is a 2020 private equity fund currently fundraising and investing. You Can Help Clients Balance Risk With Growth Income and Equity-Income Mutual Funds.

Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact for our. Bain Capital Tech Opportunities Fund II LP. We focus on founders passionate about transforming major industries ranging from SaaS infrastructure software.

Bain Capitals second Tech Opportunities fund is. Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year after wrapping up the strategys debut fund with 125.

107 billion Target size. Bain Capital Tech Opportunities Fund secured 107 billion according to a Form D fundraising document. Bain Capital Tech Opportunities Fund LP.

Read Full Story. Bain Capital Tech Opportunities. Bain Capital Tech Opportunities pursues investments in application software fintech and payments healthcare IT and infrastructure security.

Bain capital tech opportunities fund ii lp Tuesday February 22 2022 Edit. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year after wrapping up the strategys. With over 40 strategies to help your clients achieve their financial goals.

November 24 2021. It is now ahead of its 1 billion target reported last October by Buyouts. Pursue Growth From Health-Care Companies Worldwide For Over 30 Years.

The Bain Capital Tech Opportunities Fund LP is targeting up to 1 billion to make control and late-stage growth investments in midmarket tech deals. Our team draws upon individuals. First close First close date.

Bain Capital Tech Opportunities founded in Boston. Bain Capital is back with its second tech-focused fund that looks for opportunities in the red-hot sector. Bain Capital Life Sciences pursues investments in pharmaceutical biotechnology medical device diagnostic and life science tool companies across the globe.

The team combines deep domain expertise with the ability to tap the. Bain Capital is back with its second tech-focused fund that looks for opportunities in the red-hot sector details from a US pension. We combine deep domain.

Bain Capital S New Technology Fund Makes Maiden Investment Wsj

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

Bain Capital Tech Opportunities General Partner Llc

Athenahealth Acquired By Hellman Friedman And Bain Capital Business Wire

Bain Capital Targets 1 5bn For Second Tech Opportunities Fund Private Equity Insights

Bionexo Announces R 450 Million Investment From Bain Capital Tech Opportunities Bain Capital

Athenahealth Acquired By Hellman Friedman And Bain Capital Private Equity Insights

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

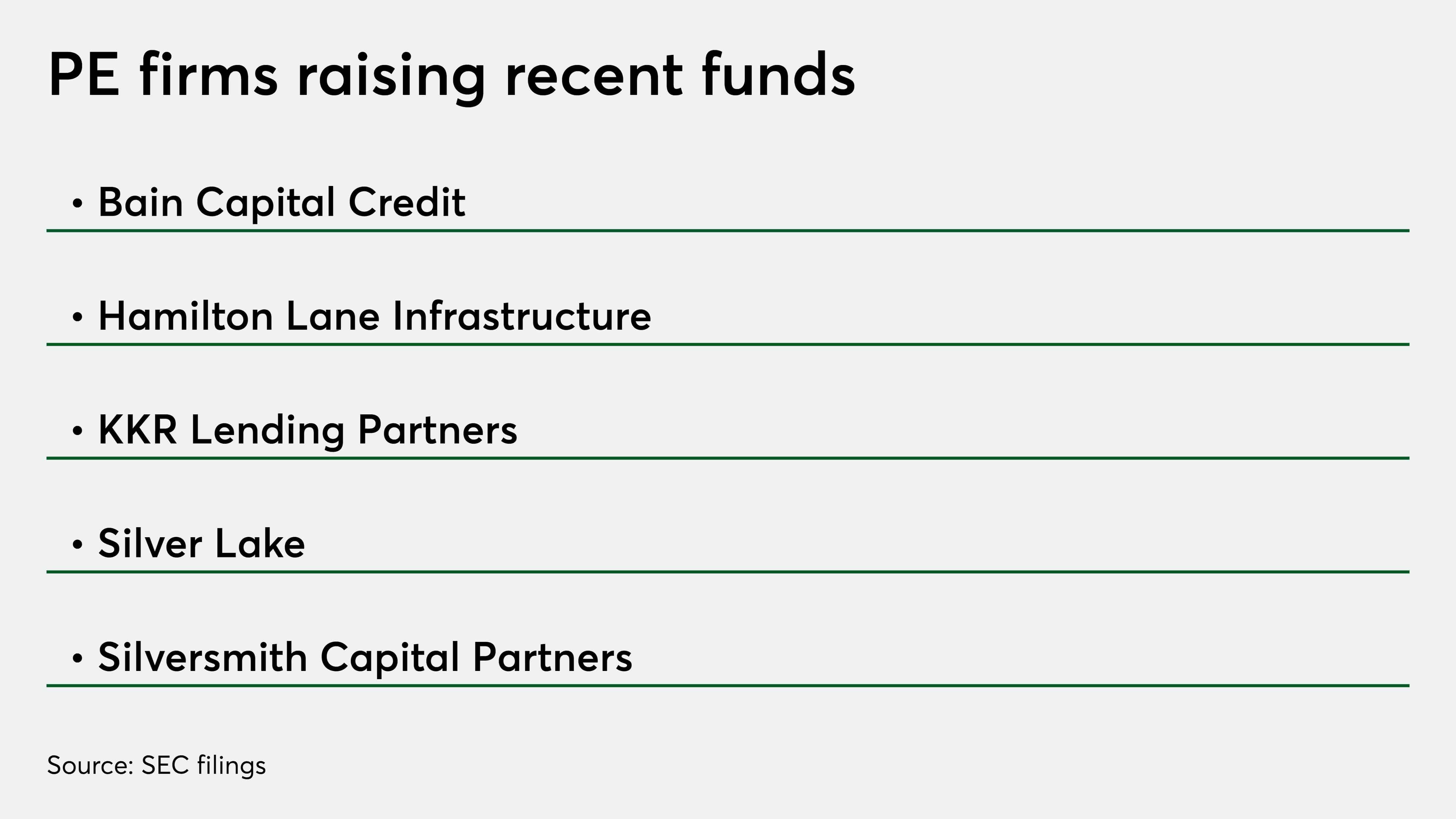

Pe Fundraising Scorecard Bain Capital Hamilton Lane Kkr Silver Lake

When I Work Secures 200 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Our People Bain Capital Tech Opportunities

Bain Capital S New Technology Fund Makes Maiden Investment Wsj

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Buyouts

Industries Bain Capital Private Equity

Our People Bain Capital Tech Opportunities

Bain Capital Private Equity Current And Former Portfolio Companies Bain Capital Private Equity